With the tax filing deadlines right around the corner, it’s that time of year when forms, files, and signatures occupy center stage in people’s minds. However, the April 15th, 2024 deadline is one of many aspects to account for. As businesses restructure and evolve through every fiscal year, figuring out the “how” of your taxes can present challenges even to seasoned professionals.

Whether you’re a first-timer or familiar with taxes, all it takes is one oversight or miscalculation to throw a wrench in the works. Nobody likes having to shell out extra fees for late payments due to logistical delays in filing their taxes. To address that, here are some of the most common mistakes in IRS Tax Returns, along with our tips on sidestepping them with aplomb.

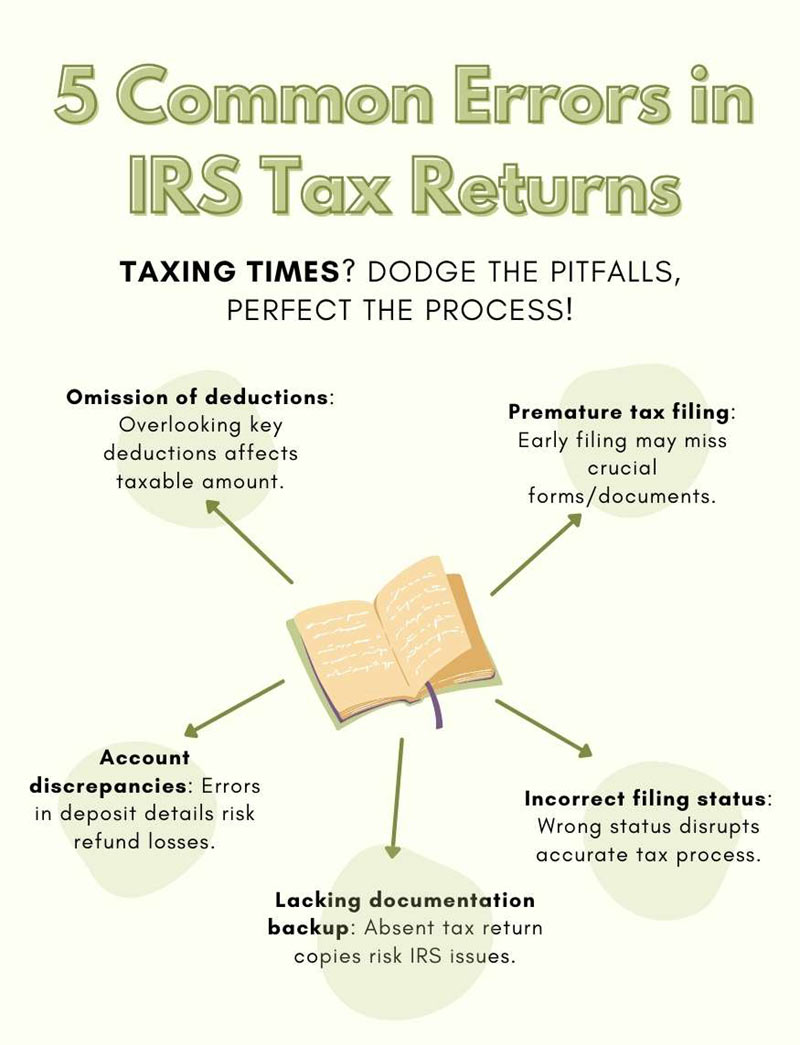

List of 5 Common Mistakes in IRS Tax Returns

1. Omission of deductions and credits

A fair chunk of the legwork of tax filing is in consolidating all the deductions you qualify for. Missing out on key deductions (such as charity donations) can snowball into greater discrepancies in your final taxable amount. Diligence in tracking all possible deductions translates to significant savings.

Solution

Always double-check with dedicated taxation software. Removing human error from the tax equation is crucial to streamlined filing. Tax preparation software and outsourcing your bookkeeping can guarantee hassle-free tax consolidation. Modern software solutions also come equipped with auto-alerts for potential deductions.

2. Premature tax filing

People prefer getting a head start on taxes to avoid a last-minute filing crunch. Jumping the gun in such a manner can result in omissions of crucial forms usually procured closer to the deadline, such as income reports and proof docs for deductions. Timing is key. Starting early doesn’t mean filing early.

Solution

Chalk out a flexible timeline along with an early start. For seamless tax filing, you should account for any potential processing delays, factoring in the current filing requirements. A well-planned approach prevents last-minute hassles and mistakes.

3. Direct deposit account discrepancies

If you qualify for a tax refund, having those funds e-remitted to your direct deposit account is more secure than waiting for paper checks through snail mail. Any errors in account details during filing can lead to loss of the refund, as there is no IRS framework for recovering lost electronic fund transfers. Ensuring correct details secures your refunds and also expedites the process.

Solution

Ensure your direct deposit account details are in order during filing. This includes particulars such as the routing number. Double-checking bank details saves a lot of post-filing trouble.

4. Incorrect filing status

While it may seem like another form field, your filing status anchors your taxation process from start to finish. You may end up underpaying (or even overpaying) if you choose the wrong filing status. The effect of an incorrect status disrupts the entire tax process.

Solution

Pick the appropriate filing status & and keep the documentation consistent with it. Having your thumb on the right filing status right out the gate can streamline sourcing supporting documents, such as spouse particulars.

5. Inconsistency in tax return documentation backup

Often flying under the radar amidst the tax rush, not having backups of your tax returns can catch you with your guard down if the IRS faces issues processing your tax return filing. A simple backup acts as a shield against unexpected challenges.

Solution

Maintain a copy of your tax return after filing with the IRS. This can serve as a safety net in case of IRS complications and help you curate a year-by-year tax record for your business. Organized documentation will make sure you’re always prepared for any tax-related inquiries.

Additional Common Errors and Mistakes in IRS Tax Returns

- Not Reporting All Income: Missing out on reporting any income source, including freelance or gig economy earnings, can lead to discrepancies.

- Mathematical Errors: Simple arithmetic mistakes can significantly impact tax calculations and liabilities.

- Claiming Ineligible Deductions: Incorrectly claiming deductions not applicable to your situation.

- Filing Late Without Extension: Missing the deadline without filing for an extension results in penalties.

- Neglecting State Tax Returns: Overlooking the need to file state taxes alongside federal returns, where applicable.

- Using Outdated Forms: Avoid errors by using only the latest tax forms and schedules from the IRS website.

- Outdated Personal Information: Update personal details like your address on your tax return to ensure effective communication.

- Incorrect Charitable Contribution Claims: Keep precise records of donations and follow IRS documentation rules to avoid scrutiny.

- Misreporting Health Insurance Status: Report your year-round health insurance coverage accurately to ensure correct credit and penalty calculations.

- Ignoring IRS Notices: Address IRS notices promptly to prevent complications and misunderstandings.

- Errors in Reporting Education Credits: Understand and accurately report eligibility and expenses for education credits and deductions.

FAQ

Can I claim home office deductions?

Yes, if you meet specific IRS criteria for home office use.

How do I know if I need to file a state tax return?

Check your state’s tax requirements, as they vary. Most states require filing if you’re a resident or have income from that state.

Are electronic tax returns safer than paper returns?

Electronic filing is generally more secure and faster, reducing the risk of errors and delays.

What happens if I can’t pay my tax due?

Contact the IRS to discuss payment plan options. Avoiding payment can lead to penalties and interest.

Conclusion

Which of these common errors have you encountered in your tax journey? Share below!

Our team is with you every step of the way, offering flexible solutions designed to make filling TAX returns easier for your business. Need help with understanding deductions? Reach out to us! Please email us at [email protected].

2 Responses

Ugh, the same thing happened to me! Overlooked my charity donations last year, and it stung when I realized the missed deductions. Having a checklist or even a simple spreadsheet seems like a game changer. Appreciate the insights in this post!

Oh no, JakeT_94! We feel your frustration. Those overlooked details do come back to bite. A checklist or spreadsheet is a smart move. Thanks for sharing your experience.