Submitting a patient’s claim to their insurance provider and receiving payment may seem straightforward. However, the reality is that there is much more involved in this intricate process of creating a claim, sending it through a clearing house, and then waiting for the health plan to respond on the status of the claim. Experienced billers know that the details are crucial to success, as even the most minor mistake can result in denial or delays.

A staggering 30% of medical claims are denied or rejected on their first submission. Therefore, it is essential to understand that every claim undergoes a thorough adjudication process before being approved or denied by the payer. So, while it may be tempting to think of claim submission as a simple task, it’s essential to have a deep understanding of the nuances involved to ensure success.

Discover how to take charge of the adjudication process and boost your Provider’s chances of successful claim payments. Our comprehensive guide offers valuable insights on implementing the proper workflows to keep your claims moving smoothly through the system.

Do not wait for better outcomes – get started today with our expert tips and strategies for maximizing your claim adjudication success.

What is Claim Adjudication?

Have you ever wondered how health plans determine how much they owe your healthcare provider after you submit a claim?

This is where claim adjudication comes into play!

It is a complex process that involves carefully reviewing each claim and making one of four decisions:

1. Pay it in full

For healthcare organizations, receiving full payment is the ultimate goal, which means seeing a credit appear in their bank account. So, next time you wait for insurance reimbursement, you will know what is happening behind the scenes!

2. Pay a contracted amount

Sometimes, payers may only pay a part of the claim. This can occur when the billed service level does not match the diagnosis or procedure codes, resulting in a partial or reduced payment. While this may be unanticipated, other reliefs are sometimes available by way of appeals.

3. Reject the claim as needing more details as in prior authorization

A rejection could mean that some key information is missing on the claim, and the Provider can resubmit the claim with the missing information. The resubmitted claim will then get paid.

4. Deny the claim

The most unwanted result is a denial. This can happen if there are any errors in the submission process. When a claim is denied, it gets sent back to the healthcare organization with a reason for denial. A denial, if seen as unjustified by the Provider, can be appealed and may have a chance of getting paid.

But what exactly happens during the claims adjudication process?

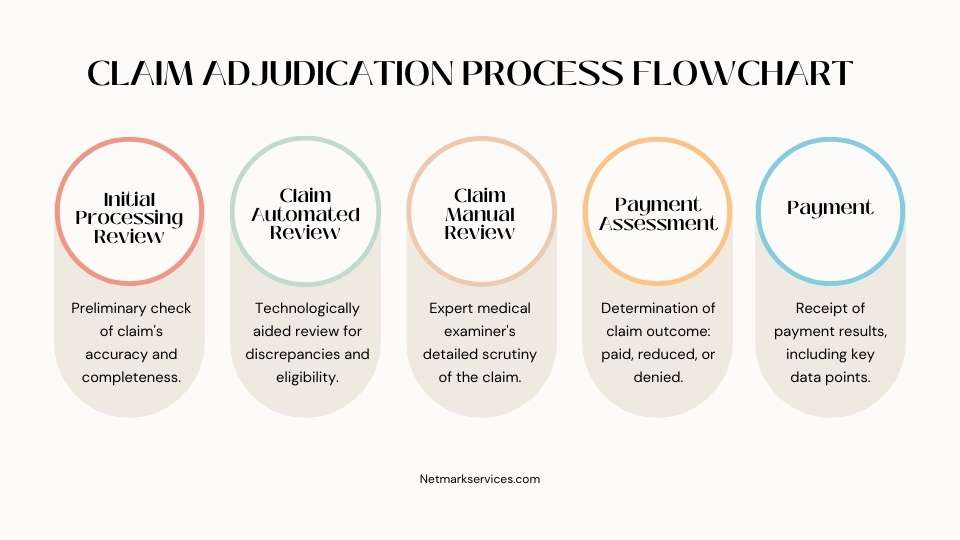

Claim Adjudication Process Flowchart

Let us look at a typical claim adjudication process flowchart to understand better how claims move through the system. This will help you identify the steps involved and where they fit in.

STEP 1: Initial Processing Review

The prequel to a health plan examining a claim is the clearing house running some “must have” checks on the claim, viz…the beneficiary ID, the NPI number, Date of service, etc., to name a few.

The first step for a health plan is to conduct an initial review. This serves as a basic check of the claim’s accuracy and completeness. During this phase, the payer will ensure all necessary information is present and that there are no discrepancies regarding charges or coding.

It may come as a surprise, but this is the step where many claims get rejected. Payers meticulously comb through each claim, searching for the slightest mistake or missing information. If errors are detected, the claim is returned to the healthcare provider for correction and resubmission.

One of the things they focus on is the precision of verifying that all patient data, such as

- Name,

- Date of birth,

- Insurance information,

- Diagnosis codes and

- Procedure codes

- After that, review if any applicable modifiers are needed.

When a claim does not pass this stage, it will be returned to the submitting organization and marked as “denied.” However, denials do not mean the end of the process, as you can resubmit the claim. Nevertheless, this requires using company resources to make adjustments and resubmit.

STEP 2: Claim Automated Review

The next step is for insurance payers to review the claim more closely. The claim must meet the payer’s specific criteria and guidelines to ensure accuracy and fairness in the reimbursement process.

The automated review procedure, equipped with advanced technological systems, checks for any discrepancies or irregularities in the claim submission and assesses the claim’s eligibility.

This step seeks to determine if:

- The patient was eligible for the service on the relevant Date,

- Pre-certification or authorization was either absent or invalid,

- The claim is a duplicate,

- The deadline for submitting the claim has passed.

- The diagnosis or procedure code is incorrect, or

- The services performed were not medically necessary.

The claim will pass to the next step if it meets these criteria. Otherwise, the claim will be rejected or denied.

STEP 3: Claim Manual Review

Once the initial steps have been taken to process a medical claim, it is time for the experts to take over. A highly-trained medical claim examiner carefully scrutinizes each case, sometimes with the help of a nurse or physician.

This critical step is seen as a vital safeguard by most payers. Occasionally, the examiner may request additional medical records to ensure the claim is justified – a precautionary measure for procedures not typically listed.

If the manual review finds discrepancies or errors in diagnosis or procedure coding, the claim is immediately sent back for correction and resubmission.

STEP 4: Payment Assessment

The journey of a healthcare claim through the adjudication process ultimately leads to one of three outcomes: paid, reduced, or denied. Finally, after all these rigorous steps have been completed, the payer must decide whether to approve or deny the claim.

Paid means the claim was approved for reimbursement, reduced means the service level billed was deemed too high and downgraded, and denied means the claim was not considered eligible for a refund. These determinations occur only after the claim has passed three review phases, ultimately resulting in healthcare organizations being paid for their services by payers.

STEP 5: Payment

The next step in the adjudication process is receiving the result of your claims, which is usually associated with money. However, it is essential to see past the label of “payment” and understand you will also receive further information.

Payers explain why they provide money, reduce payment, make adjustments, or deny uncovered charges. This information is crucial to understanding the outcome, and it is not just a simple transaction of “payment.”

Here are the key data points for your reference:

- Payer Paid Amount,

- Allowed Amount,

- Patient Responsibility Amount,

- Approved Amount,

- Discount Amount,

- Covered Amount, and

- Adjudication Date.

Let Us Talk About a Significant Headache in Medical Billing: Claim Denials

Of all the possible payment statuses a claim can receive, “denied” is the most frustrating. Did you know that nearly one-third of all claims get denied?

It is a staggering statistic and a significant pain point for healthcare organizations. When a claim is denied, it does not pass all the necessary checks during the payer’s adjudication process and gets sent back to the submitting organization. Anyone who has dealt with claim denials knows how time-consuming and stressful this process can be.

When an insurance claim is denied, the payer is not covering the cost of the services you provided to a patient. It is common to feel frustrated when this happens, but it is important to remember that denial does not necessarily mean you will not receive payment.

Discovering a denied claim can feel like a significant setback for healthcare organizations. But fear not because payers allow for the resubmission of denied claims through a process known as appealing. This involves some detective work to locate any errors in the claim, fixing them accordingly, filling out a thorough appeal letter, and resubmitting the claim for consideration.

However, take the time and resources it takes to appeal a claim – it can cost even more than the initial submission. So, staying diligent and accurate during the claims process is essential to avoid unnecessary appeals.

Understanding the ins and outs of the health claim adjudication process is essential for success in healthcare. It is a complex system, with many little details that can make all the difference when getting paid or having an insurance claim denied. However, if you know what to look for and how to navigate the process, you will be well on your way to successful claim adjudication.

Adjudication is Made Easier with Netmark Business Service

Navigating the insurance world can be daunting, and submitting claims is no exception. The term “adjudication” is thrown around, which essentially refers to the process insurers use to decide whether or not to reimburse your organization. This process often feels like pulling teeth, especially because much of it is beyond your organization’s control. But fear not; with patience and persistence, you can successfully navigate the complex world of insurance payer adjudication.

We hope this guide has helped give you an understanding of the health claim adjudication process and how Netmark Business Service can help make it easier for you.

Our team is composed of experienced professionals who understand the ins and outs of healthcare, making them experts in helping you navigate complex health claim adjudication processes.

From initial claims submission to appeals and payment, Netmark Business can ensure your organization gets the best healthcare services possible. By leveraging our cutting-edge technology and expertise in medical billing, Netmark Business can help you maximize efficiency and accuracy while minimizing costly denials.

Find out how Netmark Business Service can help simplify health claim adjudication for your organization today! Get in touch with us to learn more.